PensionBox

End to End SaaS Technology for Running Pensions

Digitising your process is one thing but ensuring an excellent experience for both you and your customers is another. While your previous workflow may just help you do the job, you did have to switch between numerous platforms to get tasks done – this is where a lot of time is being unnecessarily wasted. Imagine if one platform is under maintenance, your workflow will be on hold and no customers could proceed to the next stage due to the platform being under maintenance. This is an inconvenience at its best. When you want to get the job done so you can assist new customers, the last thing you want is previous customers being put on hold due to one of the many platforms that you’re using for your workflow being under maintenance. Pushing one task back can lead to pushing more tasks back. In a business world, this isn’t ideal.

Introducing you to our PensionBox, where usability and accessibility are a core foundation of our technology for a better experience for customers and advisors. CTC’s PensionBox adviser hub allows advisors to manage everything from one platform while the information being sent to the customers may be received on the PensionBox customer hub, where communications and notifications will be all in one place and customers may conveniently revisit their account at any time.

What is CTC’s PensionBox?

PensionBox is the retirement in a box software solution that gives new entrants to the market an easily deployable end to end solution.

PensionBox is a perfect solution for providers in the financial sector who are looking to expand their business opportunities by easily tapping into the new market without any hassle. All the solutions we build will have you and your end customers in mind, with compliance guaranteed and an excellent customer journey.

What is included with CTC PensionBox

Pension Administration

CTC’s Administration technology solution is 100% cloud-based, allowing you to perform all your administration tasks from one individual dashboard. View this as a dashboard of your responsibilities - the only difference is that all your responsibilities are automated, so you can just oversee everything that’s going on.

Administration consists of pensions and wrap cloud-based business processing, providing communications, contribution processing, and full administration to diverse pension providers from auto-enrolment, Workplace, to SIPPs and SSAS.

Actuarial Product Configuration layer

CTC’s Actuarial product engine; contains 30 years of pensions development of over 200 Pension Providers and spanning over 15 Regulatory Regimes. All shapes of pension provided with any number of permutations, all broken down into minute level of detail. This means products can be set up and configurable for every territory, covering product frameworks from EU and the UK including territory tax rules implementable at every product level.

Products contain the following overarching elements; Investments, Contributions, Charges, Withdrawals. The product engine can configure the following on all product types allowing for full administration and illustrations, taken to market at speed.

User Interface

We utilise our extensive actuarial background and our powerful calculations engine to underpin the foundations of the project, taking care of the financial details, while our design expertise provides the creative digital mindset by putting the user at the centre of everything PensionBox. We ensure every solution meets the WCAG 2.1 accessibility guidelines making your platform easy to understand, simple to use, and jargon-free, when possible.

This does mean that absolutely everything could be done in one place on the customer hub, including planning for their retirement or customer engagement if paired with our Digital Microservices Portfolio. The idea is for members to be able to map everything out and have a summary in their hands where they can revisit and manage it at any time.

How can PensionBox help your organisation

CTC understands that every company wants to own their own applications but achieving an in-house build can take a huge commitment of both time and money. We have been a perfect fit for some of the UK’s biggest life and pensions companies. We can work with you to develop a tactical solution, which can be marketed quickly with the use of your own brand and style. CTC can get you the market share now, whilst you work on your longer-term strategies.

Improved usability

With customers in mind as end-users, the processes are well thought out and simple for customers to follow through the process without having to visit your advisory organisation.

Mobile-first approach

No matter which device customers decide to use, our technology adapts to the user’s screen size to ensure a flawless experience.

In portal notifications system

Easily view any updates on their account, our technology will ensure to send customers any changes notifications.

Improved pension summary

Imagine having a full summary of your retirement financial life all in one platform, including plans on how you plan to view it. By allowing customers to visually see how everything is from the bird’s eye view, it has been scientifically proven to help.

Improved pension management

No matter in which areas of their lives their money is coming from, where it is saved, and how they plan to allocate and use it.

Easy integration

with additional modules including Income Drawdown process and retirement planning.

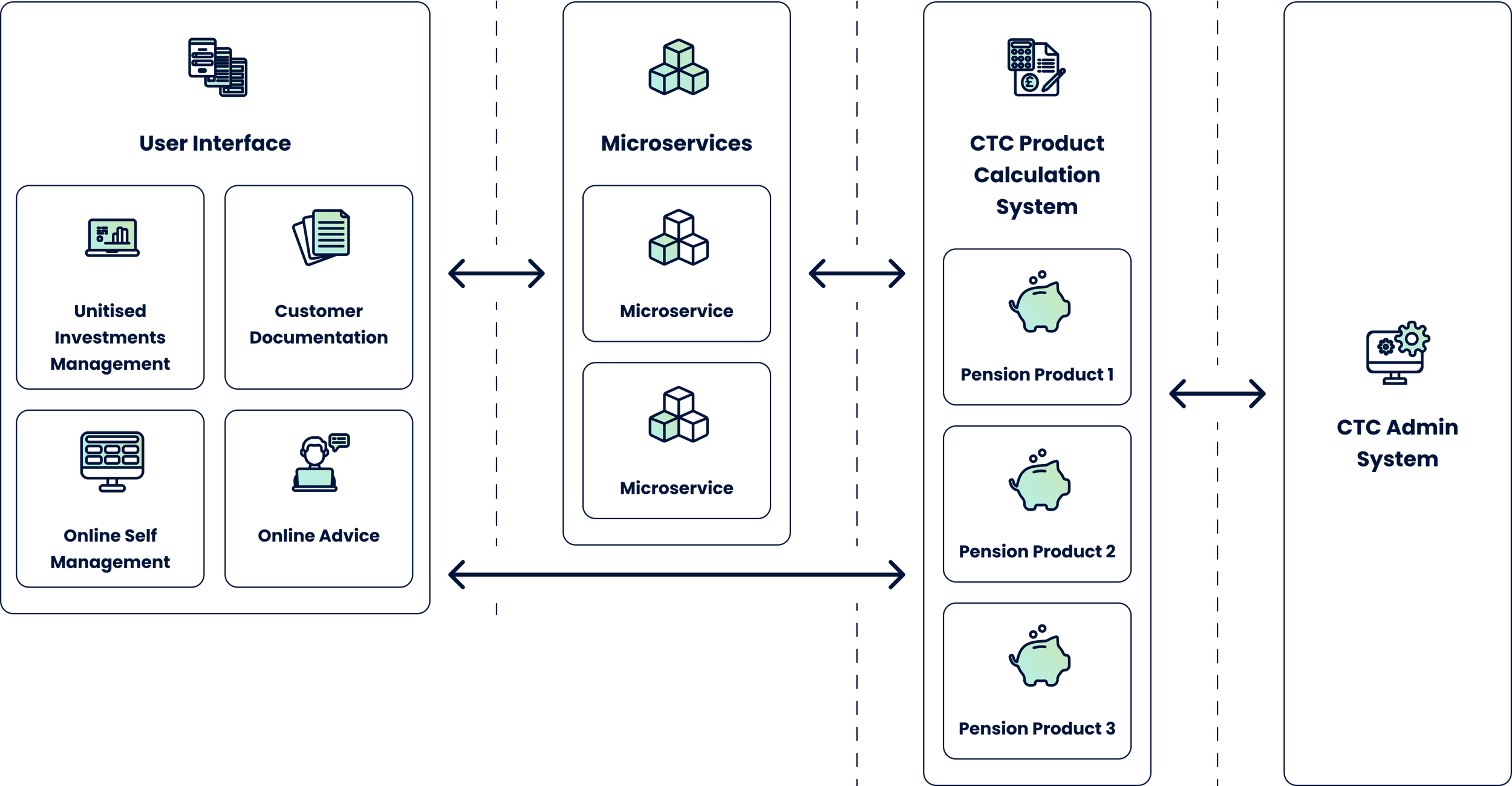

How PensionBox integration works

A solution that can be easily deployed to work with your existing systems through APIs without a worry of any interferences. Once set up, you will be ready to provide your customers with an excellent service.

Saving the cost and hassle of hosting applications, CTC typically provide its applications under a SaaS model. We are however equally comfortable supporting an on-premises deployment.

PensionBox configuration steps

Step 1

Select version

Step 2

Select admin system

Step 3

UI options

Step 4

Add microservices

PensionBox UK functionality includes:

New pension application form

Pension summary

Manage my details

View transactions

View documents

Pension transfers

Investment breakdown

Manage contributions

Simpler statement Basic contribution planner (excluding decumulation customers – drawdown calculator instead)

If you require further functionality to our PensionBox product, this can be incorporated into your solution by utilising are expansive range of microservices from our Digital Microservices Portfolio. Our microservices cover all things pensions from; Retirement Planning, Pension Withdrawals, Customer Engagement, Pension Illustrations & Investment Management.