PEPP Cube

Expand your business with Pan-European Pension Product through CTC’s technology (PEPP Cube) helping you automate the full PEPP process without a hassle.

With over 240 million savers who are based in the European Union, offering Pan-European Pension Product (PEPP) means nothing but an increase in your business opportunity and expanding your business offering to more individuals around the Union. With the flexibility of PEPP, this will attract many new customers with PEPP being cost-efficient.

In a world that we live in like today, it makes sense to offer PEPP to those who are putting payments into their pensions pot by choice while they enjoy travelling and working abroad around the European Union; some even travel as a primary part of their life meaning you will be able to tap into offering the PEPP service in a new market within a new market making it a niche.

With PEPP being introduced, we think this has definitely created an opportunity for many pensions providers, but it depends on whether or not providers are ready to take this opportunity to expand their business. Although not many providers offer PEPP yet, this gives those who offer PEPP at an early stage a higher chance of being the trusted provider through building the portfolio in this arena earlier than those who start offering the service later. It is easier to build a legacy when you don’t have to compete against too many other providers.

With many complications and regulations involved, we understand this won’t be an easy mission for you. That’s where we can help you make this simple. Similar to our DCube technology which offers pensions drawdown services to pensions providers in the UK, we are able to use the same technology as DCube and adapt the changes towards PEPP.

It really is PEPP in a box! A complete solution from administration through to customer engagement to allow you to get to market quickly, at a low cost with a great proposition.

CTC’s end to end Pan-European Pension Product (PEPP) Solution

Market Opportunity | From March 2022, insurers, banks, pension funds and asset managers will be able to offer a PEPP giving each provider a great opportunity to enter the new European markets

Challenging Territory Rules | Providers are required to adjust tax relief/credit to all underlying aspects of the product

Inflexible Technology | Existing systems are not set up for this level of flexibility

Extensive Technology Requirements | Requirements for Admin, Illustrations and Digital in each territory

Features

Application

Admin

Member & advisor portal

DCube comprises three main technology sections:

Full pension policy administration

Actuarial Product Configuration layer

Digital self-service front end

PEPP cube contains the same components with the following enhancements:

Full pension policy administration

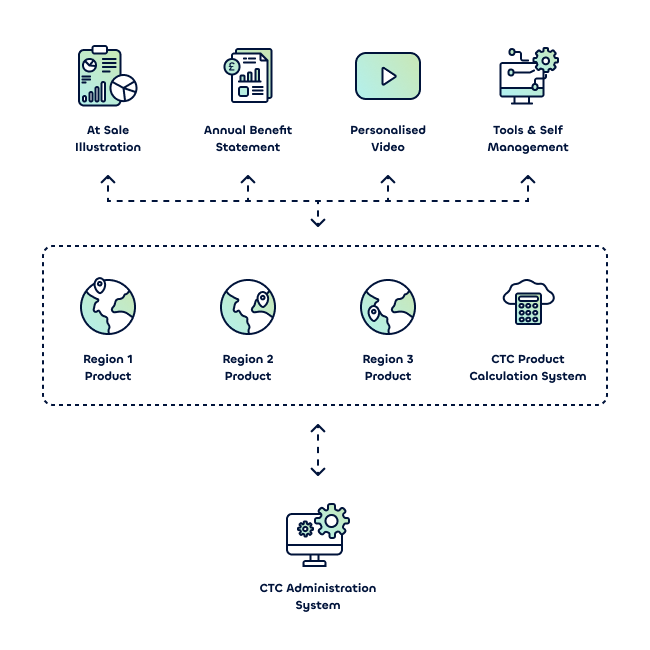

Portfolio of products (wrap account) amended to be multi-territory (instead of multi wrapper)

Actuarial Product Configuration layer

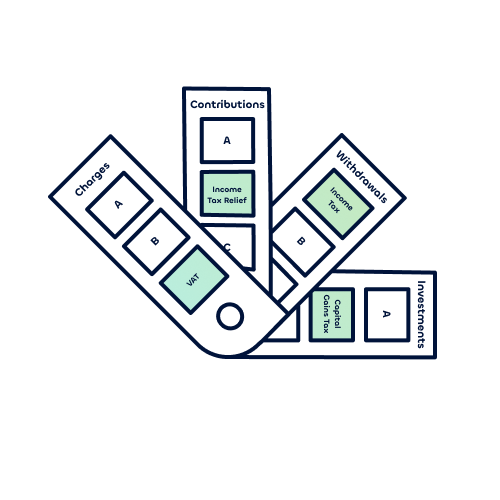

Tax treatment is applied at the product layer (Instead of by the customer)

Digital self-service front end

Supports multi-language option

Supports assisted adviser option

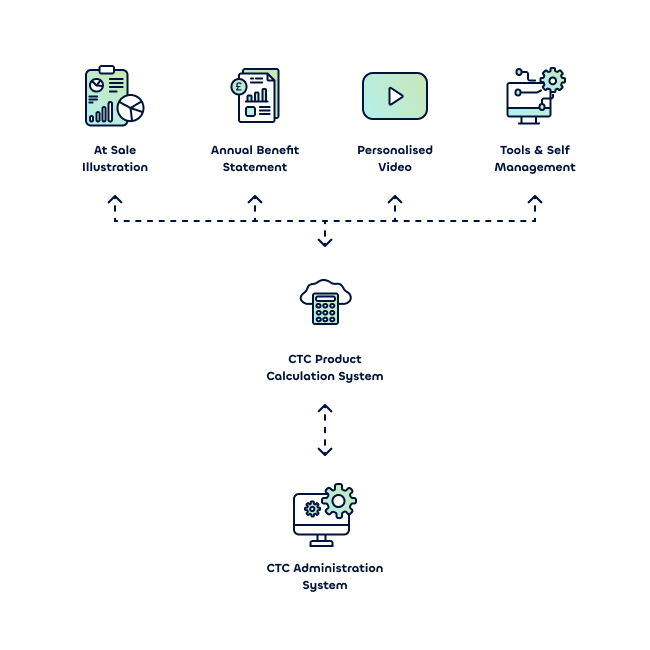

The PEPP solution will help you automate the whole PEPP process through:

PEPP Cube Product Engine

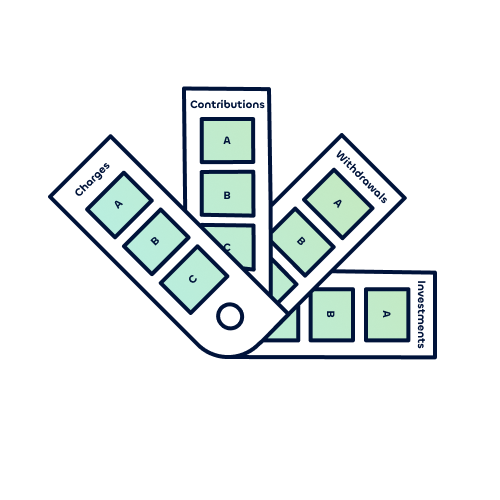

The real challenge with a multi-territory pension product is handling the differing tax treatments. Any of the different tax variants can be added to any of the different product features. CTC’s engine can handle any number of product variations and any tax treatment added to any level or feature of a product.

How will you or your clients benefit from PEPP?

What’s in it for your organisation

Your organisation will be able to tap into new European markets;

Your organisation will be able to offer pensions service to a wider group of demographic;

Offer this service fully online which means it can attract younger European residents;

If your clients were to select PEPP, they can feel 100% confident with their decisions;

By offering this service online through CTC PEPP Cube, you may distribute your business across the European Union with one single product;

Apart from the implementation of this service to your organisation, CTC will take care of the rest;

Fully automated process while helping you comply with your local regulations.

What’s in it for your clients?

Designed to give your clients more choice;

Ideal for those who travel and work between countries;

In case portability isn’t an option, clients may switch to other PEPP providers at no cost that may allow them to continue to contribute towards the PEPP;

Clients will understand all costs and will be able to receive their own personalised pension benefits;

This is a voluntary retirement savings program which means clients may contribute at their own will;

Have the flexibility to be anywhere in the European Union and save towards their PEPP product selection;

Should your clients wish to opt out of PEPP, they can do so after a minimum of five years of contribution;

Automated for the end customer.

Why choose CTC’s PEPP Cube

CTC’s product engine:

30 years of development

Over 200 Pension Providers trust us

Over 15 Regulatory Regimes

All shapes of pension provided

Any number of permutations

Broken down into the minute level of detail

Configurable for every territory

Core PEPP product framework

Territory tax rules implementable at every product level

Hosting

Saving the cost and hassle of hosting applications, CTC typically provide its applications under a SaaS model. We are however equally comfortable supporting an on-premises deployment.